Partner News

February 2022

Media Super and Cbus are preparing to merge

Media Super is planning to merge with Cbus, the industry super fund for those who build Australia.

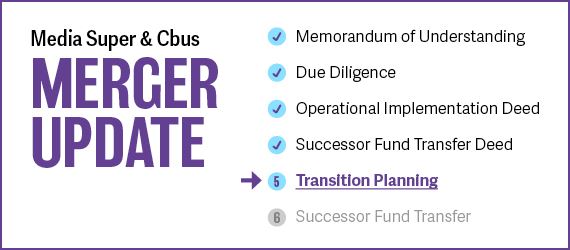

Media Super Limited (the trustee for Media Super) and United Super Pty Ltd (the trustee for Cbus) have signed a merger agreement, which is an important milestone in the merger journey. While there are still some approval processes that need to happen, both funds are working towards completing the merger process before the second quarter of 2022.

Media Super’s planned merger with Cbus is driven by our objective to improve outcomes for our members. The focus remains on supporting members in the print, media, entertainment and arts industries, as we have for more than 30 years.

After the merger, the Media Super brand and industry focus will continue, and members will be part of a much larger and growing combined fund.

We’ve found the right partner to continue our proud legacy

Media Super is proud of our heritage and industry focus, and we have been performing well for our members, with strong long-term returns and competitive fees. Our sole objective is to provide strong outcomes for our members in retirement. However, we’ve realised that the increasing complexities of superannuation and rising costs mean the best outcome for our members is to find a merger partner.

We are always looking after our members’ best financial interests, and that is why we have found a like-minded merger partner in Cbus. The super fund for those who build Australia, Cbus has more than $65 billion in funds under management and 775,000 members (as at 30 June 2021).

Cbus has a history of low fees, strong investment performance and excellent service.

We share the same mission

Media Super and Cbus share the same mission: better retirement outcomes for members. Being industry super funds, both Media Super and Cbus have a similar culture and shared values.

Increased scale and growth also benefit members by providing access to more investment opportunities, greater scope to manage fees effectively and access to products and services, including for those approaching or currently in retirement.

What happens next?

The merged fund will have more than $70 billion in assets and manage the retirement savings of around 850,000 hardworking members.

Media Super members and employers will still benefit from products and services tailored to their industries while also gaining access to the benefits of size and scale that come with belonging to a larger fund.

Those benefits include access to more investment opportunities, greater scope to manage fees effectively and access to innovative products and services, including for those approaching or in retirement.

Media Super and Cbus are now focused on transition planning to integrate investment, administration, and operations. This is a comprehensive process, with both funds ensuring the plan will deliver a result that’s in the best financial interest of members.

Our focus is squarely on delivering strong long-term investment returns and retirement outcomes for Media Super and Cbus members.

Download the PDF of this press-release here.

If you have any questions, please call our Helpline on 1800 640 886 or get in touch with your Business Development Manager.

This communication provides general information only, and does not take into consideration your personal objectives, situation or needs. Before making any financial decisions you should first determine whether the information is appropriate for you by reading the Product Disclosure Statement and/or by consulting a qualified financial adviser. The Target Market Determination is at mediasuper.com.au/TMD. Investment returns are not guaranteed, and past performance gives no indication of future performance. Issued by Media Super Limited (ABN 30 059 502 948, AFSL 230254) as Trustee of Media Super (ABN 42 574 421 650).